As I am writing this, Dow Jones is at its 52-week low of 21,792.20 after suffering a -653.17 (2.91%) drop during Christmas Eve. Since we are on the topic of 52-week lows, here's the updated table for the STI stocks which I have mentioned in my previous blog posts. All prices here are the closing prices on Wednesday 26 December 2018.

Stocks which managed to rebound nicely out of their lows are Keppel, Singtel and SATS. You may recall I mentioned that I am interested in buying SATS at 4.5 and now it is at 4.61, 1.3% above its low. New stocks to the 52-week low list now include UOL, Thai Beverage and UOB which fell a little recently. These stocks also made new 52-week lows during this period which does signify some level of bearishness.

On a very superficial level of analysis, I still think there is room for STI to drop. Currently, it is at 3,011.15, after dropping 39.91 points or 1.31% today. However, it hasn't been really falling in tandem with the US markets in terms of direction and magnitude. It is still short of its 52-week low of 2,955.68 which I think will breach soon. Japan's Nikkei dropped 5.01% during Christmas in the light of US uncertainty and rebounded slightly here.

Although the current US futures are showing a slight rebound here, I am still rather worried about the stock market prospects due to a number of pertinent risks. Firstly, the rate hikes from the Federal Reserve should be top on the list, as an increased cost of borrowing money will contract the economy and pressure the stock markets. Secondly, the current political uncertainty in the Trump administration is worrying too; will the man be impeached? Will he build his wall? Or will he continue his war with China on trade? His unpredictability certainly translates into uncertainty and possibly a bearish stock market. Thirdly, trade war tensions are also key here, where increased tarrifs do adversely affect company profits and the stock market. In the light of these risks, I am waiting to buy at a lower level than current market prices to give myself some margin of safety, should these risks hold true. I will be seeing if STI will hover near the 2,950 mark and see if it will return to 2016 lows. I will likely be a buyer during those lows.

On my radar too are some reits (real estate investment trusts) which are of interest to me. The one that I am most interested in is Parkwaylife Reit, currently trading at 2.62.

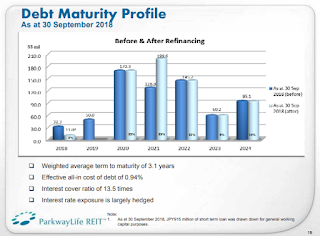

I will like to keep this short, so I am going to jump straight into the points that appeal to me. The first highlight is how it is handling the interest rate hikes.

Source: Parkwaylife Reit 3Q 2018 Results Presentation

Its interest cost is only 0.94% which means for every $1,000 it is borrowing, it only has to pay $9.40 in interest costs. This is quite low considering that Federal Reserve recently hiked rates to 2.5%. Notably, its interest cost is one of the lowest among Singapore reits, which gives me much comfort. A good interest cover ratio of 13.5 also means that the reit can pay interest payments for 13.5 years based on its current profit. In terms of interest payment, this is one of the better reits to choose from.

Second point which I like is the increase in Net Property Income (NPI) for this year. This is rather obvious, because it is a nice bonus if the reit can increase its profit so that it can pay out more distributions to its unitholders (aka you and me). According to the presentation, this was attributed to higher rent amounts from the reit's properties. Another plus point is the constant increase of distribution per unit (DPU) for the past 10 years which is a testament to its track record.

Source: Parkwaylife Reit 3Q 2018 Results Presentation

Source: Parkwaylife Reit 3Q 2018 Results Presentation

Other essential details would include the Net Asset Value (NAV) which currently sits at 1.76 and gearing which is 37.7%. From a NAV perspective, the reit might be too overvalued at 2.62 as you are paying 86 cents more for every unit purchase. However, I can understand the premium so far due to its advantages in its more favorable interest rate management. Gearing is also at a comfortable 37.7%, well below Singapore's regulatory 45% for all reits. From a dividend yield perspective, in 2018, the reit is currently trading at about 5% yield. Current 52-week low is at 2.56.

I will be waiting to see if Parkwaylife Reit will continue to trade lower given the bearish sentiment in the markets. Interestingly, Singapore reits have not been falling as hard as the STI stocks (non-reits). Capitamall Trust is instead near its 52-week high, which I am rather surprised by.

What are the stocks that you all are interested to buy? Please share!