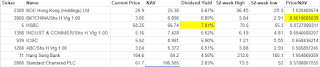

We see that HK banks are trading to a premium to NAV and have attractive dividend yields as compared to SG counterparts. However, we must be well aware of the underlying risks that are entailed.

The main risk here is the HK protests which saw an escalation in tensions after a 'mask-ban' was introduced by the government. In my opinion, I think a resolution (at least in the short term) is highly unlikely and we might see more funds pulling out of HK. Perhaps the steep discount of HK stocks might warrant us to have a second thought about buying HK banks.

Naturally, the second risk is the trade war where HK is likely to be hit hard too in terms of exports, especially due to its high reliance on China capital.

This might of course be a good bet, if the tensions do cool down and HK banks will indeed rally hard. But your guess is good as mine.

What do you think?