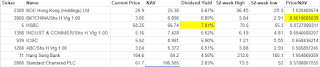

We see that HK banks are trading to a premium to NAV and have attractive dividend yields as compared to SG counterparts. However, we must be well aware of the underlying risks that are entailed.

The main risk here is the HK protests which saw an escalation in tensions after a 'mask-ban' was introduced by the government. In my opinion, I think a resolution (at least in the short term) is highly unlikely and we might see more funds pulling out of HK. Perhaps the steep discount of HK stocks might warrant us to have a second thought about buying HK banks.

Naturally, the second risk is the trade war where HK is likely to be hit hard too in terms of exports, especially due to its high reliance on China capital.

This might of course be a good bet, if the tensions do cool down and HK banks will indeed rally hard. But your guess is good as mine.

What do you think?

Hi Benjamin

ReplyDeleteIf you have did some deep dive analysis on HK banking stocks or stocks in general, feel free to share as any serious analysis is much appreciated. Looking forward to your sharing!

Click here to Forex No Deposit Bonus 2020 List. >>> Forex No Deposit Bonus 2020 List

ReplyDeleteGood Information. I have a question regard the stocks. Which is

ReplyDeleteI keep hearing it’s crucial to be diversified. Why?

glen india

what is stock market

marksans pharma news

colgate palmolive share price bse

top gainers today

v guard

stock recommendations for short term

type of share market

Thank you! I am a regular follower and I always try to read all your articles and most of the times it really helps for us. Here we also offer some great content. Check one before you left.

ReplyDeleteColgate-Palmolive (India)

Hindustan Zinc Ltd.

Maruti Suzuki India Ltd

Sagar Cements Ltd

Nice article. stockinvestor.in shares information related to stock market like stock market analysis, advice the tips to invest in thestock market, and also provides stock market recommendations.

ReplyDeletecommodity

futures contracts

futures exchange